A Certified Financial Planner (CFP) is a professional designation for financial planners who have met rigorous education, examination, experience, and ethical requirements.

Here’s a detailed overview of what a CFP is, the benefits of working with one, and how to find the right CFP for your needs:

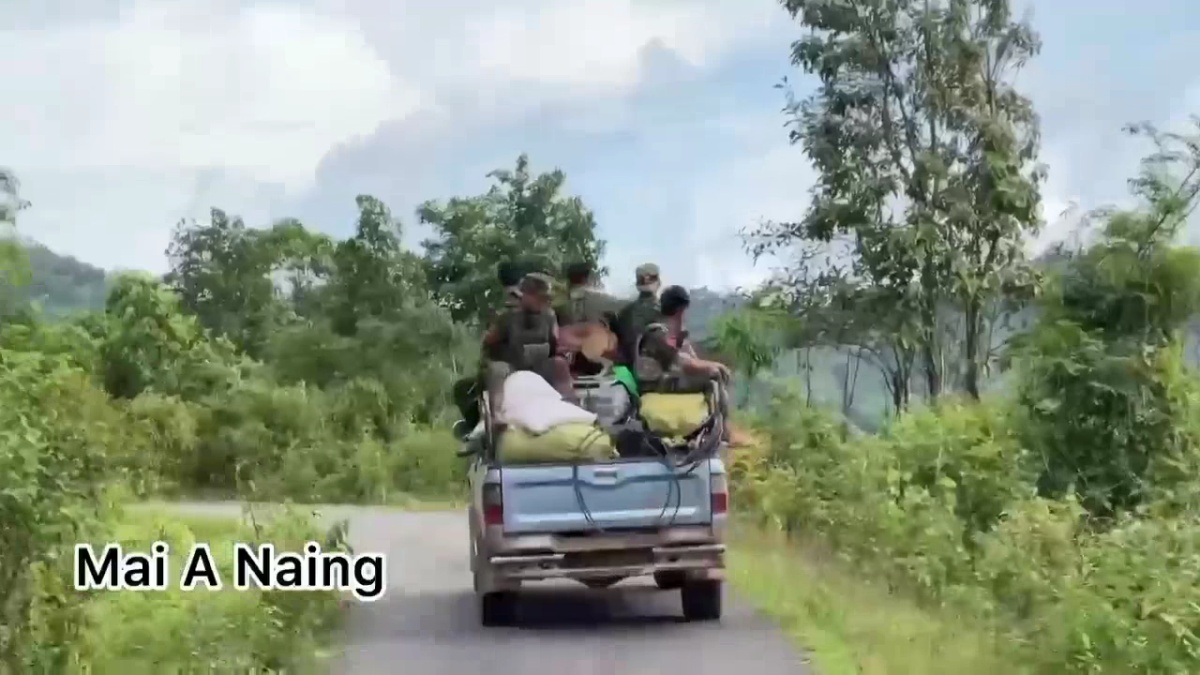

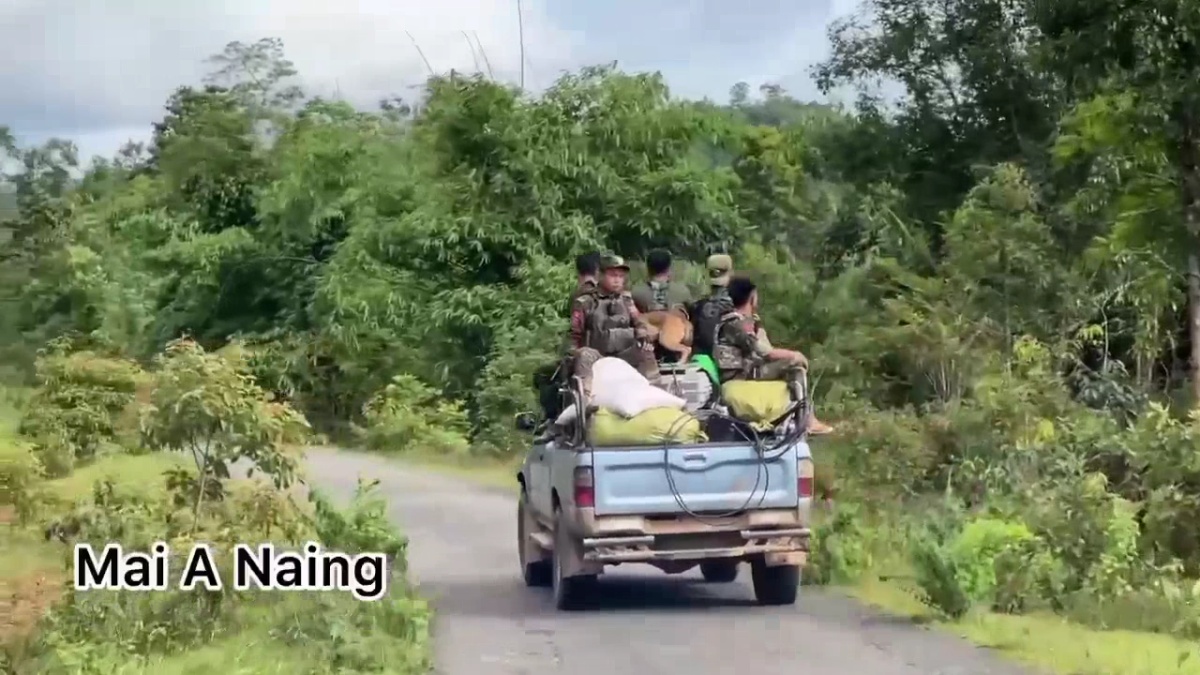

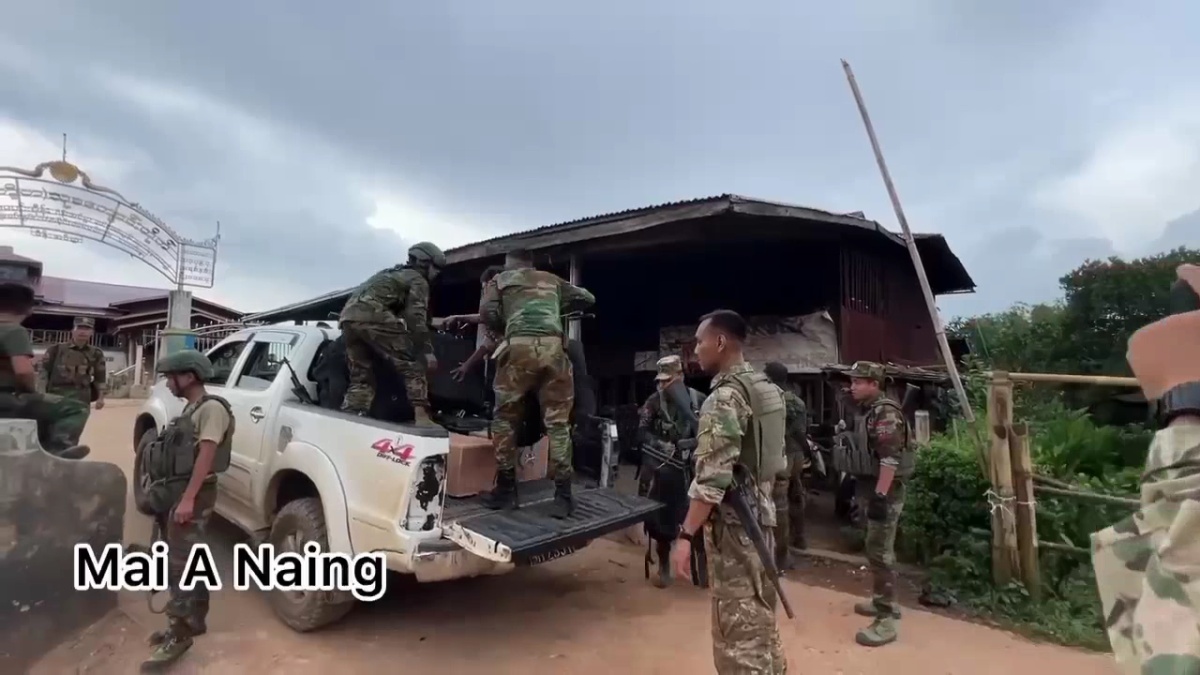

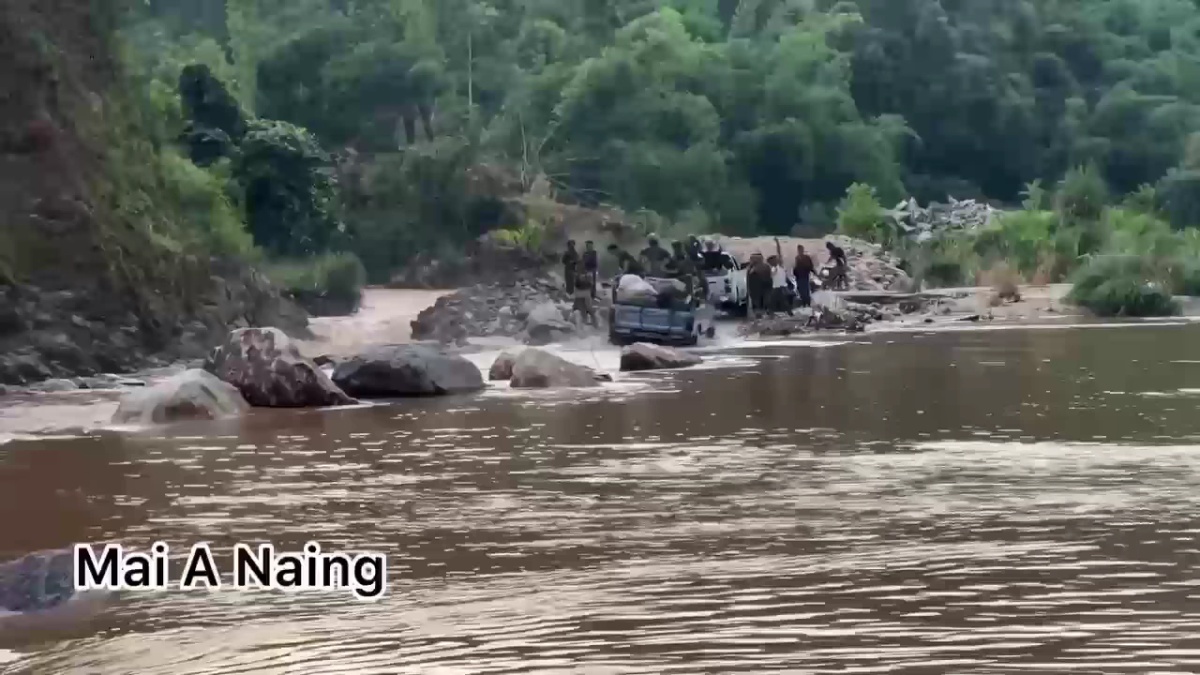

Video by Mai A Naing

What is a Certified Financial Planner (CFP)?

Qualifications

Education:

Must complete a comprehensive course of study in financial planning approved by the CFP Board, covering topics like investment planning, insurance, estate planning, retirement planning, and tax planning.

Typically, this is through a bachelor’s degree program or a CFP Board-registered program.

Examination:

Pass the CFP Certification Examination, which tests the candidate’s ability to apply financial planning knowledge to real-life situations.

Experience:

Accumulate at least three years (6,000 hours) of full-time, relevant financial planning experience, or two years (4,000 hours) of apprenticeship experience.

Ethics:

Agree to adhere to the CFP Board’s Code of Ethics and Standards of Conduct, which require acting in the best interest of clients and maintaining integrity and professionalism.

Continuing Education:

Complete 30 hours of continuing education every two years to stay current with financial planning practices and changes in the industry.

Benefits of Working with a CFP

Comprehensive Financial Planning:

CFPs are trained to take a holistic approach to financial planning, considering all aspects of your financial life.

Expertise and Knowledge:

They possess a broad knowledge of financial planning topics and are capable of addressing complex financial situations.

Ethical Standards:

CFPs are held to high ethical standards, ensuring they act in your best interest.

Personalized Advice:

They provide tailored advice based on your unique financial situation, goals, and risk tolerance.

Fiduciary Responsibility:

Many CFPs are fiduciaries, meaning they are legally and ethically required to put your interests above their own.

How to Find the Right CFP

Research and Referrals:

Start by asking for recommendations from friends, family, or colleagues.

Use the CFP Board’s website to search for CFP professionals in your area.

Check Credentials:

Verify the CFP’s certification status and check for any disciplinary actions or complaints on the CFP Board’s website.

Initial Consultation:

Schedule a meeting to discuss your financial goals, the CFP’s services, and their approach to financial planning.

Questions to Ask:

Experience and Specialization: Ask about their experience and if they specialize in any particular areas (retirement planning, tax planning, etc.).

Services Offered: Understand the range of services they provide.

Fee Structure: Clarify how they charge for their services (fee-only, commission-based, or a combination).

Fiduciary Status: Confirm whether they act as a fiduciary.

Assess Compatibility:

Evaluate whether their communication style and approach align with your preferences and if you feel comfortable working with them.

Key Considerations

Transparency:

Ensure that the CFP is transparent about fees, potential conflicts of interest, and any other relevant information.

Regular Reviews:

A good CFP will regularly review your financial plan and adjust it as needed based on changes in your financial situation or goals.

Ongoing Education:

Make sure they engage in continuous education to stay updated with the latest financial planning trends and regulations.

Conclusion

A Certified Financial Planner (CFP) can provide valuable guidance and expertise to help you achieve your financial goals. By choosing a qualified and trustworthy CFP, you can benefit from personalized and comprehensive financial planning that aligns with your best interests. Take the time to research and select the right CFP to ensure a successful and beneficial partnership.

Leave a Reply